FOCUS: Climate Finance: Sustainable Finance Market in Transition to a Green Resilient Future

DATE: November/December 2023

VENUE: COP28, Republic of Zambia and WWF Pavilions

CONCEPT LEAD: Jonnathan Mtonga (Manager – Monitoring and Evaluation)

RESPONSIBILITY OWNER: Mutumboi Mundia (Chief Executive Officer)

Background

Climate change is one of the most serious global challenges that is threatening the environment, human societies, livelihood, global and national economies. Mitigating and adapting to climate change is a priority of all nations and requires substantial financial resources to support the transition to a low-carbon and limit the global temperature pre-industrial levels. Last year, COP 27 which was held in Egypt had an emphasis on climate finance and was positively viewed as a moment for developed countries to fulfil their pledges, commitments, and support towards the implementation of the Paris Agreement.

Climate financing refers to the financial resources provided to support projects, initiatives, and policies aimed at addressing climate change and its impacts. The funds are used to implement interventions and measures that contribute to mitigation (reducing greenhouse gas emissions) and adaptation (building resilience to climate change effects). Climate financing is a crucial aspect of global efforts to combat climate change, as it enables countries, communities, and businesses to transition to a more sustainable and resilient future.

The private sector and financial institutions can play a crucial role in facilitating the needed climate financing investments. Linking Climate Finance to the private sector and financial institutions is essential for harnessing resources, expertise, and influence to support climate action. Collaboration between funders, intermediary institutions and SMEs can deliver sustainable impact and contribute to a more sustainable and resilient future.

Prospero’s Mandate & Interest in COP28

Prospero is a growing brand in Zambia that is associated with being a partner to Small and Medium Entities. The years of working with SMEs in Zambia and providing an array of support services as well as catalytic financing has earned Prospero the recognition of it being a first port call for many interests within the SME eco-system in Zambia. Given our mandate to help SMEs grow and our conviction that SMEs hold the key to unlocking the much-needed jobs for the youth in Zambia, Prospero has identified the need to help attract impact finance for Zambian SMEs as an essential matter warranting strategic thinking. COP 28 being an international forum where diverse funders showcase their sustainability offerings and seek to network with both existing and potential partners, it is worthwhile for Prospero to leverage the forum.

As part of Prospero’s sustainability strategy, Management is expected to enhance its efforts towards on-boarding other like-mind funders whose vision aligns with that of Prospero and its current main funder (FCDO). FCDO are supportive of Prospero as it journeys to becoming a sustainable entity. At the core of becoming sustainable, Prospero’s aspiration is to position a fund of funders, managing and administering several funds for multiple donors. Furthermore, COP28 is a platform to learn more about strategy and innovations that will be worth considering as we position to attract and support more SMEs as well as cater for gender. COP 28 therefore presents an excellent opportunity particularly that sustainability is an agenda that Prospero has prioritised.

Key Areas of Focus in the Sustainability Agenda

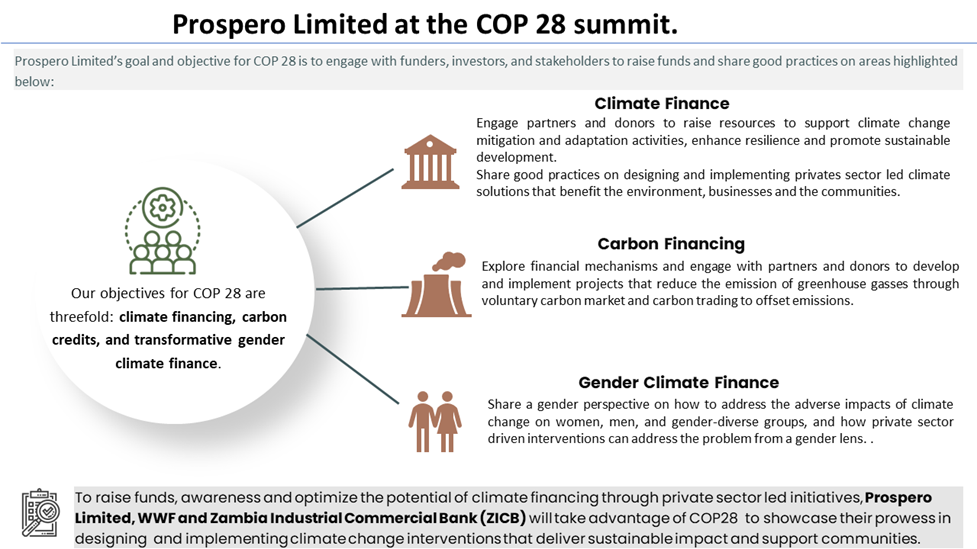

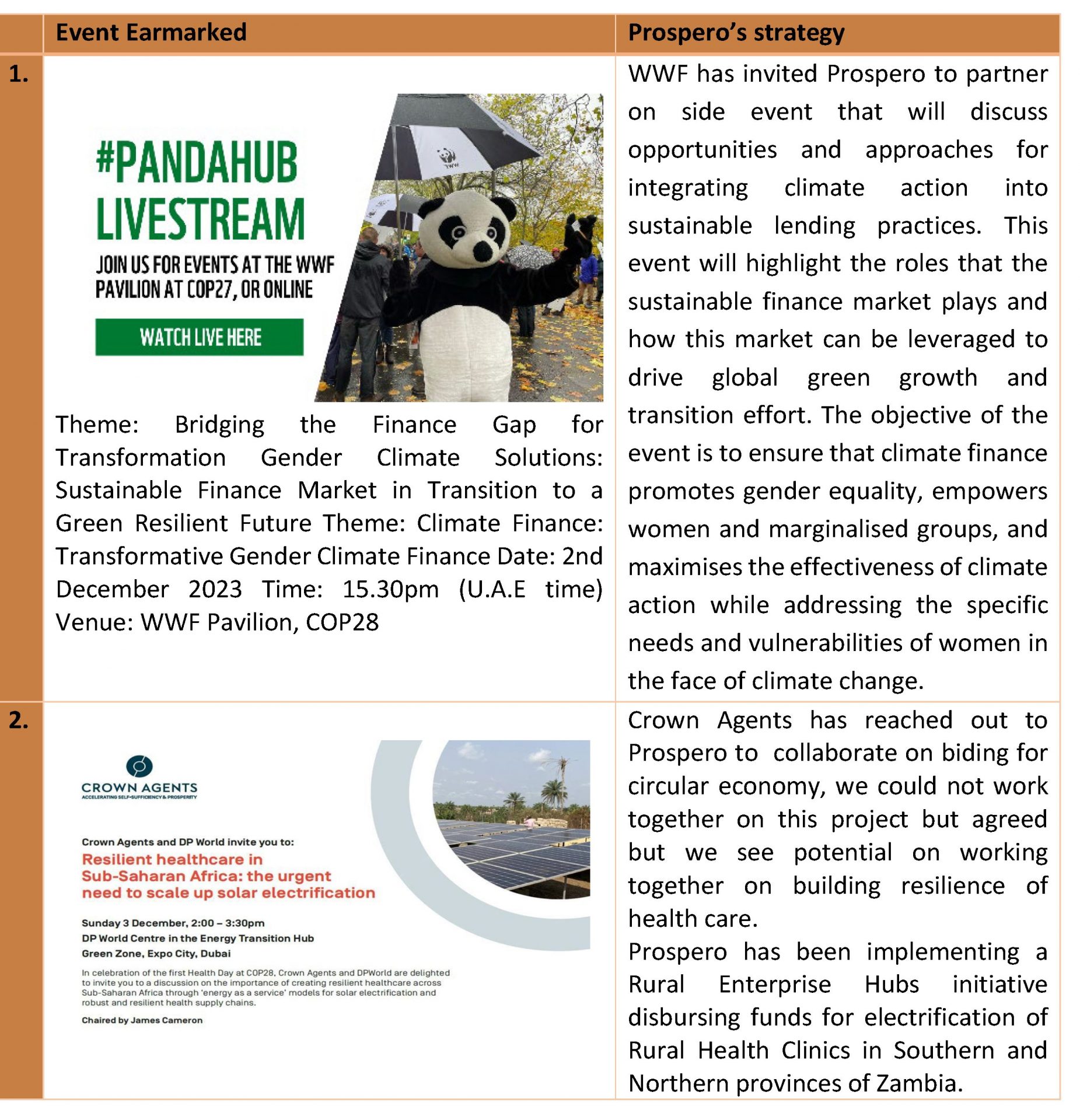

Small and medium enterprises (SMEs) play a crucial role in addressing climate change due to their significant contribution to economic activities, and collectively they have a substantial influence on sustainability. To raise awareness and optimise the potential of climate financing through private sector led initiatives, Prospero Limited and Zambia Industrial Commercial Bank (ZICB) will take advantage of COP28 to showcase their prowess in designing and implementing climate change interventions that deliver sustainable impact and support communities through SMEs. Further, COP28 will be a good platform for Prospero to demonstrate impact and share knowledge of carbon financing initiatives and strategies being piloted and implemented. Prospero will also participate on a panel discussion on Transformative Gender Climate Finance to the private sector and financial institutions looking at how to harness resources, expertise, and influence to support gender-inclusive climate action.

Prospero’s Objectives at COP 28

Using our experience and track record on supporting private sector led climate solutions and leveraging on COP 27 commitments and goals, we will use COP 28 as a platform to engage with funders and stakeholder on integrating climate action into business financing initiatives. We will be going to COP28 with a mission anchored on three objectives: Climate Financing, Carbon Credits and Transformative Gender Climate Finance.

Climate adaptation financing

Climate finance is a critical component of the global response to climate change, as it helps countries and communities transition to low-carbon, climate-resilient pathways. COP27 emphasized on adaptation and new pledges of over USD 230 million were made to the Adaptation Fund to help vulnerable communities adapt to climate change through concrete adaptation solutions. Global Goal on Adaptation will be concluded at COP28 and inform the first Global Stocktake on building and developing resilience among the most vulnerable communities. At COP28, UN Climate Change’s Standing Committee on Finance will be presenting a report on doubling adaptation finance for consideration.

The Global Goal on Adaptation is a good entry point at which Prospero together with ZICB can showcase its private sector led initiative that finances businesses to develop profitable and viable business models that support climate adaptation. The consortium runs climate finance debt facility aimed at combatting effects of climate change through Small and Medium Enterprises (SMEs). The financing facility’s primary objective is to mobilise financial resources for projects that contribute to a sustainable and climate-resilient future Launched in December 2021, this facility has been instrumental in supporting SMEs whose projects either mitigate the effects of climate change or enhance the adaptive capacity of local communities.

At COP 28, working with government and ZICB, Prospero will engage a minimum of 3 financiers, donor agencies and bilateral organization that support climate adaptation initiatives that channel

funds into businesses in developing countries including Zambia. The goal will be to raise awareness on the potential of the private sector to drive sustainable climate adaptation and advocate for more funding.

Carbon financing and trading

Prospero aims to engage a minimum of 3 funders, 1 donor agency and 1 bilateral organization that support carbon financing and trading.

Prospero has positioned itself to act as a third-party and finance intermediary taking up the role of facilitating public-private dialogue to ensure an enabling environment for carbon initiatives is shaped well for businesses and communities alike. With vast experience in the Zambian private sector landscape, Prospero is well positioned to help Zambian corporates and SME owners seize carbon finance opportunities through developing, facilitating and implementing sustainable projects that reduce or remove greenhouse gas emissions.

Carbon financing also involves the implementation of voluntary carbon market as a tool to climate financing based on Article 6 mechanism under the Paris agreement which allows industrialized countries to invest in emission reduction projects in developing countries to offset their own emissions.

In line with its ambitions, Prospero is working on the development of multistakeholder partnerships and accelerate identifying and providing technical assistance to viable carbon projects. The initiative supports climate change mitigation projects from inception to implementation, channeling financial and technical assistance towards private sector-led carbon initiatives that would otherwise not get off the ground.

Transformative gender climate finance

Transformative Gender Climate Finance represents a critical dimension of climate finance that addresses the intersection of climate action, gender equality, and social inclusivity. Prospero will work together with WWF sponsor and hold an event highlighting the roles that the sustainable finance market plays and how this market can be leveraged to drive global green growth and transition effort. Importantly, the session would discuss the key lessons learned from different stakeholders in this area. The side event will discuss opportunities and approaches for integrating gender and climate action into sustainable lending practices.

Opportunities and Rationale/Strategy for Engagement at COP28

COP28 will bring together more than 30,000 participants to share ideas, solutions, and build partnerships and coalitions. This year’s conference will provide an opportunity for the Zambian government, civil society and other local stakeholder including Prospero Limited to engage with the global community, course correct, brainstorm on impactful solutions and drive progress to keep 1.5C within reach in line with the ambitions of the Paris Agreement.

The COP28 UAE Presidency believes that governments and the private sector must work closely together to address climate change. COP28 UAE offers the private sector the opportunity to showcase their contributions and solutions to the global climate challenge. Innovative approaches, climate action technologies and entrepreneurship will constitute an important part of COP28 UAE. The conference will also host technical conferences, panels, and activations with a focus on existing and future solutions to climate change mitigation.

The following are few of the many entry points for engagements at the COP28 to drive the climate change agenda for Zambia:

COP 28 Engagement Outcomes

We anticipate that our engagements with stakeholders at COP 28 will have an impact on the financing and implementation of climate mitigation and adaptation projects and interventions especially in developing countries including Zambia. Our engagement with various stakeholders in the climate financing sector will result to any and/or all the following outcomes:

ANNEXES

Prospero Limited and Zambia Industrial Commercial Bank (ZICB) International Climate Finance Portfolio

Background

As part of the Green compact agreement signed between the UK and Zambian Governments, Prospero Limited and Zambia Industrial Commercial Bank launched the Climate Finance Facility to provide concessional loans to Zambian SMEs to mitigate and build resilience of climate change.

This pool of funding will provide finance to different local business projects that build awareness around climate change and empowers citizens to make meaningful behavioural changes that are beneficial to the environment and climate.

Prospero Zambia has funded approximately, GBP1.2mn to its seven (7) preselected SME’s that have met its investment criteria.

Prospero Zambia has assumed full credit risk in this initiative and lend out through the Bank at concessional interest rates.

The Deal Structure

In this initiative, Prospero is assuming the full credit risk of the loans at concessional interest rate for on lending – indicating a below-market interest rate and lower collateral requirements for MSME beneficiaries.

Prospero identified the MSME businesses to receive concessional loans and prescribed loan tenors and collateral cover. In this case even though in the Bilateral Agreement it is stated that the first call for collateral should be the pledged security by the MSMEs (equipment bought), most of them, over 80 % of the portfolio received working capital support. Thus, leaving the cash cover as security against non-performing loans (NPLs).

Prospero has availed funds to ZICB for on lending at 0% interest and the agreed pricing is as follows is as per below agreed terms:

- 3.25% Fixed Interest on USD

- 10% Fixed Interest on ZMW

- 6 months grace period on Principal and interest

Seven SMEs supported by the Portfolio (among them are the following)

Company Name: Divergent Growing Systems (DGS)

Location: Solwezi, Northwestern province

Focus area: Hydroponic farming

Products: Herbs, Strawberries and Vegetable

Environmental impact: Climate resilient agriculture

Loan Value: GBP 50,000

The small hydroponic units will be tailored to the needs of farming cooperatives, particularly youth and women. estimated costs would cover materials, solar system components, training, and initial support.

DGS sustainability model is holistic, encompassing economic, social, and environmental aspects. The goal is to empower farming cooperatives, especially youth and women, by integrating them into a non-seasonal, high-value crop or fruit farming model. The solar-powered system aligns with our commitment to environmentally friendly practices, reducing the carbon footprint of our operations.

Company Name: Wuchi Wami

Location: Solwezi, North Western province

Focus area: Hydroponic farming.

Products: Organic Honey and beeswax processing and beekeeping training

Environmental impact: Climate resilient agriculture

Loan value: GBP 88,000

The initiative has empowered rural communities and women, significantly raising farmers’ earnings and creating employment. With exporter status and certifications from COMESA, SADC, and AGOA, Wuchi Wami has expanded internationally, exporting to Norway, Botswana, Namibia, and Zimbabwe. Their success is underscored by awards, including the SEED Climate Adaptation award and recognition in Forbes Magazine. Wuchi Wami exemplifies sustainable agriculture, economic growth, and environmental stewardship on a commendable scale.

Company Name: North Route Nursery

Location: Chisamba, Central Province

Focus area: Tree nursery

Products: Macadamia, avocado and citrus seedlings

Environmental impact: Climate resilient agriculture

Loan value: GBP 81,000

North Route Nursery is a macadamia, avocado and citrus tree nursery based in Chisamba. They supply commercial and emerging farmers with high quality grafted seedlings. The nursery is set-up to facilitate the propagation and grow-out of macadamia, avocado and citrus seedlings of select varieties. All of our seedlings are grown at our nursery for up to 15 months.

The SME works closely with industry experts to, ensure that we source, grow and supply farmers with true cultivars, are always at the cutting-edge of industry practice and are able to provide growers with on-going support and technical expertise. North Root is centrally located to supply the Southern-Central African region and experienced in exporting seedlings to Tanzania, Malawi and Zimbabwe.

Overall ICF Portfolio Performance

Overall, the portfolio is health and funds disbursed have been applied for their intended use by the recipients and created over 100 jobs and supported communities. All SMEs are paying back the funding and not defaulting. The Bank and Prospero will continue to engage and monitor performance to understand the full impact.